Financing Massachusetts Town Government Part 2

Financing Massachusetts Town Government: Part 2

Martin DiMunah - Bureau of Accounts Field Representative

Katie Scopelleti - Bureau of Accounts Field Representative

Tony Rassias - Deputy Director of Accounts

The following is the second of a three-part series covering the financing of annual town budgets in Massachusetts. The first part was published in our September 3, 2020 edition of City & Town . If you’re a new town official, especially a new town finance official (or plan to attend the Annual Town Meeting), we hope you will find this series helpful.

Towns finance their annual budget using different financing sources than other forms of government. It’s important to understand what these sources are, where they come from, and what limitations may be placed on them. The following article continues our look at Massachusetts town government finance.

Local Receipts

Local receipts include both General Fund and enterprise fund receipts. In FY2020, local receipts budgeted for all towns was $2.3 billion (16%) of all town budgeted revenues: General Fund totaled $1.2 billion (9%), and enterprise fund $1.1 billion (7%) of all town budgeted revenues.

General Fund Receipts

Per G.L. c. 44, § 53 , all town monies received belong to its General Fund unless allocated to another fund by law. These budgeted estimates, separate from property tax receipts, are detailed on the town’s annual Tax Rate Recap form. The top five FY2020 budgeted General Fund receipts in dollars and percentages for all towns were:

- Motor Vehicle Excise = $472M (38%)

- Charges for Services = $277M (22%)

- Penalties and Interest on Taxes and Excises = $138M (11%)

- All Other Excises including Meals & Room Occupancy = $122M (10%)

- Licenses and Permits = $113M (9%)

Enterprise Fund Receipts (Chilmark does not have these.)

The enterprise fund statute, G.L. c.44, § 53F½ , was initially enacted in 1986. Before then, special revenue funds were authorized by various general laws or special acts to separately account for business type services. These special revenue funds were:

- limited with regard to the services and costs covered,

- authorized mostly for water, gas and electric utility departments; and

- used primarily to account for annual operating costs, not the indirect costs, capital improvements or fixed assets of the service.

Enterprise funds generate most of their receipts from user charges to pay for the activity’s cost and may only be established for utility, cable television public access, health care, recreational or transportation purposes.

A complete list of budgeted and prior year actual General Fund and enterprise fund receipts received can be found in Category Four of the DLS Massachusetts Municipal Finance Trend Dashboard.

Reserves

In FY2020, budgeted reserves for all towns totaled $874 million (6.1%) of all town budgeted revenues. There are five major reserve funds available to towns: free cash, stabilization, overlay surplus, the finance committee’s reserve fund and the enterprise fund’s retained earnings.

Free Cash – the General Fund’s surplus from operations (read how Chapter 53 of 2020, Section 6 temporarily affects its appropriation authority beyond June 30, 2020).

Stabilization Fund – there are two types: general and special purpose (read how Chapter 92 of 2020, Sections 10a and 10b temporarily affects their funding and appropriation authority during FY2021).

Analysts often regard the free cash and general stabilization fund balances as core reserves.

Overlay Surplus – surplus of amount initially provided for abatements and exemptions.

Finance Committee’s Reserve Fund – appropriated to the finance committee by the legislative body, then transferred by the committee if necessary to a budget line item for an extraordinary and unforeseen purpose. The fund cannot exceed 5% of the prior fiscal year’s tax levy.

Retained Earnings – the enterprise fund’s surplus from operations.

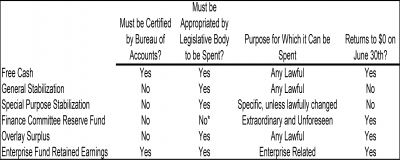

The following table shows some unique features of each reserve fund.

(* initially appropriated by the legislative body for allocation by the finance committee)

Reserves, sometimes called “rainy day funds,” prove invaluable to finance emergency spending and/or to replace lost revenues during bad economic times. They do not, however, regenerate automatically, so planning for them is important.

For more information, please read our City & Town publications from December 15th, 2016 and December 21st, 2017 on planning for free cash.

Review of Parts 1 and 2

Massachusetts town budgets are financed differently than federal, state, or county government budgets.

The six components of town government finance are the

- tax levy,

- state aid,

- local receipts,

- reserves,

- debt and

- other sources.

The property tax and Cherry Sheet aid provide towns with most of their General Fund revenue.

Other state aid includes grants to eligible towns and targeted aid to specific towns for specific purposes.

Locally generated receipts include General Fund receipts and enterprise fund charges.

A town’s major reserves are free cash, stabilization funds, overlay surplus, the finance committee’s reserve fund and the enterprise fund’s retained earnings.

Each reserve fund has its own unique features.

Consider establishing a town reserve policy. (Chilmark tries to keep between 10-15% of our annual operating budget in "reserve".)

We hope you found this information helpful. Our third article in this series will further review components of Massachusetts town government finance.